The mortgage application process can often feel like an uphill battle, laden with endless paperwork, rigorous financial scrutiny, and seemingly never-ending back-and-forth with lenders. However, with the right approach, prospective homeowners can significantly cut down on the time and hassle involved.

While the lending process does require thorough due diligence, there are ways to make it smoother, quicker, and far less stressful. As a result, many lenders and mortgage firms are now turning to outsourcing partners as well for mortgage processing, underwriting support, and document verification. By delegating key tasks, businesses can cut down on processing time, reduce errors, and improve customer experience.

In this article, we will explore the many benefits of having a partner besides to help you organize your mortgage application.

Need Help with Title, Tax, and Settlement Services?

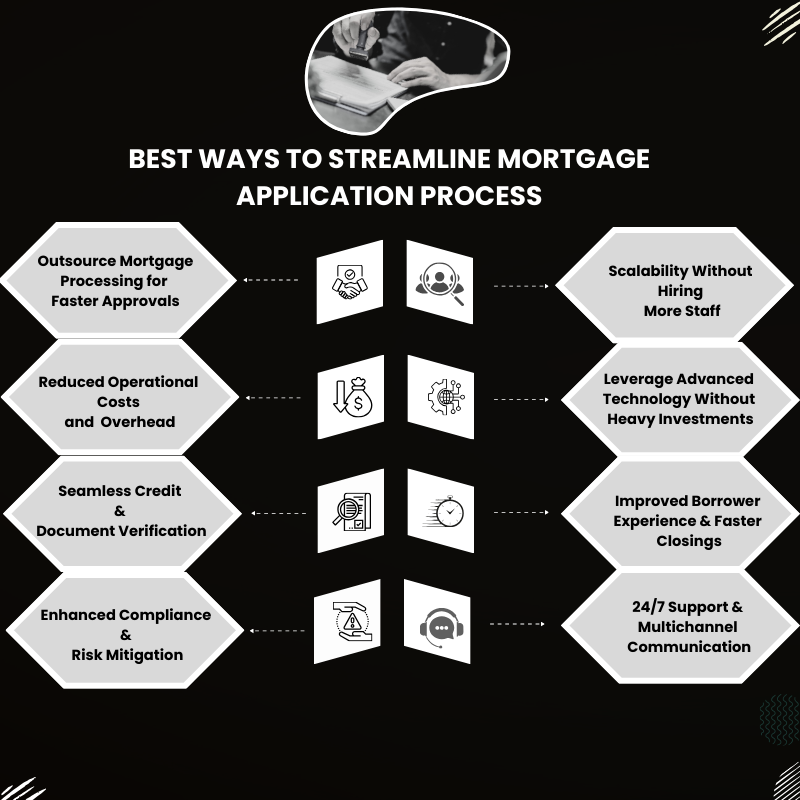

Outsource Mortgage Processing for Faster Approvals

Managing the entire mortgage lifecycle internally can be resource-intensive, requiring specialized teams to handle per-approvals, verification’s, underwriting, and post-closing audits. Outsourcing mortgage processing allows lenders to streamline operations by offloading time-consuming tasks to experienced professionals. This not only accelerates loan approvals but also frees up in-house teams to focus on customer relationships and strategic growth.

Reduced Operational Costs and Overhead

Maintaining an in-house mortgage processing team involves substantial overhead costs, including salaries, training, software, and compliance management. Outsourcing eliminates these expenses by providing access to a highly skilled workforce without the need for additional infrastructure. Companies like Trupp Global offer cost-effective solutions without compromising on accuracy, ensuring compliance with all regulatory requirements while keeping processing fees in check.

Seamless Credit & Document Verification

One of the biggest bottlenecks in the mortgage application process is document verification validating income statements, tax returns, employment history, and credit reports. With an outsourcing partner, lenders can automate and expedite this process, ensuring that documents are reviewed accurately and quickly. This significantly reduces turnaround time while minimizing the risk of missing critical compliance checks.

Enhanced Compliance & Risk Mitigation

Mortgage lending is a highly regulated industry, with frequent updates to compliance standards such as TRID, RESPA, and Dodd-Frank regulations. A team of mortgage experts stays updated on industry regulations and ensures that every loan file is processed with complete compliance. This not only reduces legal risks but also enhances the credibility of the lending institution.

Scalability Without Hiring More Staff

Mortgage application volumes fluctuate due to market conditions, interest rate changes, and seasonal demand. Instead of scrambling to hire and train staff during high-demand periods, lenders can leverage scalable workforce to manage fluctuations effortlessly. Whether you need additional support during peak seasons or want to scale down during slow periods, outsourcing provides unmatched flexibility.

Leverage Advanced Technology Without Heavy Investments

Digital transformation is reshaping the mortgage industry, with AI-driven automation, machine learning-based underwriting, and e-signature solutions becoming standard. However, investing in such technologies can be expensive. Outsourcing partners already use state-of-the-art mortgage processing software, ensuring that lenders benefit from the latest innovations without heavy capital expenditures.

Improved Borrower Experience & Faster Closings

At the end of the day, a smooth mortgage process directly impacts borrower satisfaction. With Trupp Global handling back-office operations, lenders can focus on providing exceptional customer service, reducing turnaround times, and ensuring faster closings. A well-structured, outsourced workflow means fewer bottlenecks, quicker approvals, and a seamless experience for home buyers.

24/7 Support & Multichannel Communication

Mortgage processing often involves multiple stakeholders, including loan officers, underwriters, and real estate agents. Having a reliable outsourcing partner ensures round-the-clock support for handling queries, processing applications, and resolving issues across multiple channels email, phone, or live chat. This guarantees a smooth and uninterrupted mortgage workflow, even outside regular business hours.

Want to Simplify the Mortgage Process?

CONCLUSION

Streamlining the mortgage application process is no longer just about automation or internal process optimization, it’s about strategic outsourcing. By partnering with Trupp Global, lenders can enhance efficiency, reduce costs, and deliver a faster, smoother mortgage experience for their customers. Whether it’s pre-approval support, document verification, underwriting assistance, or post-closing audits, outsourcing is the key to a scalable, compliant, and hassle-free mortgage operation.

If your lending business is looking for a trusted outsourcing partner to handle end-to-end mortgage processing, we are the ideal choice. With deep industry expertise, cutting-edge technology, and a commitment to excellence, Trupp Global ensures that mortgage lenders stay ahead of the curve without the operational burden.